The Importance of IRS Form 8822

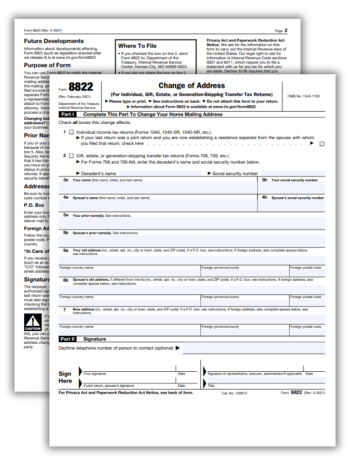

The IRS tax form 8822 frequently comes up once you move, as it is the official document the Internal Revenue Service uses to update your physical or mail address. It's crucial to update your contact information with the IRS to ensure any necessary correspondence reaches you. Being kept informed of your tax situation can help you minimize risks and maintain financial health. This form is easy to obtain. Likewise, both the IRS Form 8822 online and a physical copy are available to every taxpayer.

Federal Form 8822 & Notable Changes Implemented.

In recent years, the IRS has changed Form 8822, increasing efficiency and simplifying the process.

- The form is now easy to complete and user-friendly.

- The IRS 8822 form PDF online version has been updated, giving users an easy and convenient option to complete and submit the copy online.

- The form includes fields such as your old and new addresses, social security number, or employer identification number. It also requires the signature of the taxpayer for affirmation.

Federal Tax Form 8822: Qualified & Unqualified Applicants

Who is eligible to use Form 8822? Basically, anyone who falls under the IRS' taxpayer definition and has undergone a change of address qualifies to use Form 8822. Some of the typical applicants include businesses, trusts, non-profit organizations, and all ranges of individuals, from the self-employed to retirees. However, those who do not fall under the IRS’ taxpayer definition or whose address has remained the same need not file IRS Form 8822 online or physically. Make sure you study the instructions carefully to ensure you meet the qualifications before filling.

Mastering IRS 8822 Form: Our Recommendations

As a rule of thumb, ensure you update your address with the IRS immediately after you move. Timely filing of the updated information gives the IRS ample time to update your particulars in their database. You must make an effort to provide as much information as possible when filling out the form for it to serve its purpose effectively. After filling out the form, remember to print IRS Form 8822 for your records. The form doesn’t take more than 45 days to process and update your records. Secure your physical or digital copy as proof of your due diligence in the event of any discrepancies.

Related Forms

-

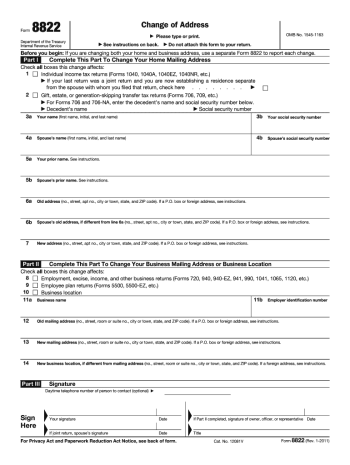

![image]() 8822 For a business owner or individual who has recently relocated or switched mailing addresses, it is crucial to maintain seamless communication with tax agencies. This is where federal form 8822 comes into play. It is specifically designed by the Internal Revenue Service to report any changes in a taxpayer's business or home location. Submitting this form ensures important taxation mail such as refunds, amendment notifications, or requirements for additional information will not be misdirected, th... Fill Now

8822 For a business owner or individual who has recently relocated or switched mailing addresses, it is crucial to maintain seamless communication with tax agencies. This is where federal form 8822 comes into play. It is specifically designed by the Internal Revenue Service to report any changes in a taxpayer's business or home location. Submitting this form ensures important taxation mail such as refunds, amendment notifications, or requirements for additional information will not be misdirected, th... Fill Now -

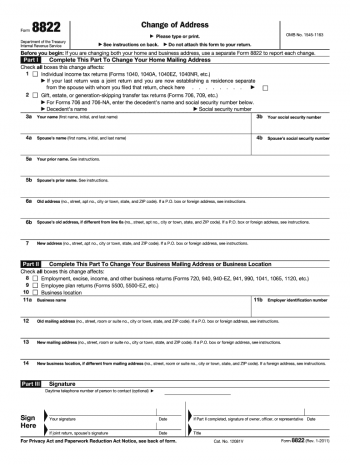

![image]() Printable IRS Form 8822 Understanding and completing the IRS tax form 8822 printable can be complex for many individuals. Form 8822, often called the Change of Address form, is designed for taxpayers who need to notify the Internal Revenue Service (IRS) about a change in their personal or business mailing address. The primary features of this form can be broadly categorized into three distinct sections, designed to capture essential taxpayer information, the reason for an address change, and the specifics of the new address. Steps to Fill Out the 8822 Form for Print Accomplishing the printable IRS Form 8822 can be simplified if steps are followed sequentially and carefully. Given below is a bullet-point section presenting concise guidance: Part IFill in your basic contact information and Social Security Number (SSN) or Employer Identification Number (EIN); also, indicate whether the form is being completed for an individual, a business, or an estate/trust. Part IIDetail your old address exactly as it appeared on your last return, and clearly define your new address alongside future tax applicability. Part IIINominate a third party in the event the form is being filled out by an authorized individual on behalf of the taxpayer. Finally, the bottom part of the form should be signed and dated by the taxpayer or authorized representative. Submitting the Printable IRS Form 8822 After accurately completing your printable tax form 8822, the proceeding step involves its safe and timely submission. Mailing addresses for submission can be found on the IRS website or on the instructional leaflet attached to Form 8822. Acknowledging the form's importance to timely tax procedures, it is particularly critical that it gets to the right tax center. Form 8822 does not have a stipulated deadline. That being said, the IRS encourages people to file it as soon as a mailing address changes. Delaying its submission might result in key IRS documents being sent to an outdated address. This could lead to missed notices, updates, and potential tax issues. Familiarizing yourself with the IRS form 8822 printable, how to complete it, and when to submit it is required for every taxpayer who undergoes a change in mailing address. Initially, It might appear daunting, but with careful attention to detail and a systematic approach, the process is manageable and straightforward. Final Thoughts While this guide aids in understanding the printable 8822 form and its completion process, it is also paramount to remember that personal circumstances differ. It may be helpful to consult a tax professional or legal advisor for guidance tailored specifically to your situation. Always remember submitting the correct forms promptly to the IRS facilitates smooth communication and ensures you fulfill your tax obligations without hurdles. Fill Now

Printable IRS Form 8822 Understanding and completing the IRS tax form 8822 printable can be complex for many individuals. Form 8822, often called the Change of Address form, is designed for taxpayers who need to notify the Internal Revenue Service (IRS) about a change in their personal or business mailing address. The primary features of this form can be broadly categorized into three distinct sections, designed to capture essential taxpayer information, the reason for an address change, and the specifics of the new address. Steps to Fill Out the 8822 Form for Print Accomplishing the printable IRS Form 8822 can be simplified if steps are followed sequentially and carefully. Given below is a bullet-point section presenting concise guidance: Part IFill in your basic contact information and Social Security Number (SSN) or Employer Identification Number (EIN); also, indicate whether the form is being completed for an individual, a business, or an estate/trust. Part IIDetail your old address exactly as it appeared on your last return, and clearly define your new address alongside future tax applicability. Part IIINominate a third party in the event the form is being filled out by an authorized individual on behalf of the taxpayer. Finally, the bottom part of the form should be signed and dated by the taxpayer or authorized representative. Submitting the Printable IRS Form 8822 After accurately completing your printable tax form 8822, the proceeding step involves its safe and timely submission. Mailing addresses for submission can be found on the IRS website or on the instructional leaflet attached to Form 8822. Acknowledging the form's importance to timely tax procedures, it is particularly critical that it gets to the right tax center. Form 8822 does not have a stipulated deadline. That being said, the IRS encourages people to file it as soon as a mailing address changes. Delaying its submission might result in key IRS documents being sent to an outdated address. This could lead to missed notices, updates, and potential tax issues. Familiarizing yourself with the IRS form 8822 printable, how to complete it, and when to submit it is required for every taxpayer who undergoes a change in mailing address. Initially, It might appear daunting, but with careful attention to detail and a systematic approach, the process is manageable and straightforward. Final Thoughts While this guide aids in understanding the printable 8822 form and its completion process, it is also paramount to remember that personal circumstances differ. It may be helpful to consult a tax professional or legal advisor for guidance tailored specifically to your situation. Always remember submitting the correct forms promptly to the IRS facilitates smooth communication and ensures you fulfill your tax obligations without hurdles. Fill Now -

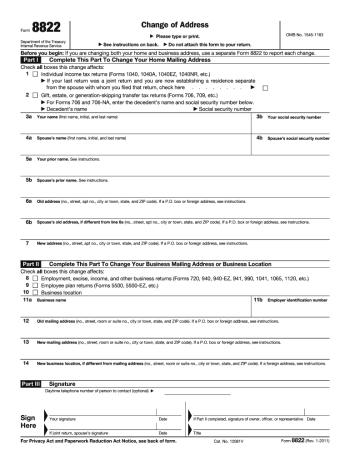

![image]() Form 8822 (Change of Address) When you alter your physical address, ensuring that the Internal Revenue Service (IRS) is notified should be one of the top priorities on your checklist. Keeping IRS apprised of your current whereabouts prevents potential delays or miscommunication concerning your tax matters. This is where IRS Form 8822 comes into play. Why File Form 8822 Typically, the majority of taxpayers must file Form 8822, Change of Address, to the IRS (only if they've relocated) to update their residential address information. However, certain circumstances might provide unusual situations requiring the use of this form. Scenario 1You act as an executor for an estate and have recently moved the office you work in. You need to ensure that any IRS communications concerning the estate reach you promptly and are not misdirected. Scenario 2Your business has expanded, and operations moved to a new location. To prevent any interference in your tax matters related to the business, you might want to inform IRS about the relocation with the IRS 8822 change of address form. Scenario 3You've recently married and changed your last name. Although it’s primarily used to report changes in address, Form 8822 can also be utilized to update your name change with the IRS. In all these instances, IRS Form 8822 will serve to communicate the vital details effectively with the IRS. The process isn’t cumbersome, and the form itself can be downloaded online, which we'll discuss momentarily. What to do if a Mistake Occurs? Human errors can transpire while filling out forms and IRS Form 8822 is no exception. It's indispensable to double-check all the information enlisted on the form before submission. However, if an error is identified post-submission, don't fret. The IRS will return to you a printable IRS Form 8822: Change of Address that needs to be correctly filled out and sent back to them. Popular Questions about Form 8822 Below are answers to some common queries about this form: Can I submit IRS Form 8822, Change of Address, online?According to the current instructions, you cannot e-file it. You have to fill out this form on paper and send it to the IRS. The address to which you have to send this form depends on your state or location. How often can I update my address?Theoretically, you can update your address as many times as you'd like. Practicality, however, dictates you only do so whenever an actual change occurs. Where can I find the form?You can print IRS Form 8822 (Change of Address) directly from our website, prepare the requisite information, and mail it to the IRS. Staying on top of changes and maintaining clear communication with the IRS can lead to smoother tax seasons. By understanding the purposes of IRS Form 8822 and how it works, you'd be doing precisely that! Fill Now

Form 8822 (Change of Address) When you alter your physical address, ensuring that the Internal Revenue Service (IRS) is notified should be one of the top priorities on your checklist. Keeping IRS apprised of your current whereabouts prevents potential delays or miscommunication concerning your tax matters. This is where IRS Form 8822 comes into play. Why File Form 8822 Typically, the majority of taxpayers must file Form 8822, Change of Address, to the IRS (only if they've relocated) to update their residential address information. However, certain circumstances might provide unusual situations requiring the use of this form. Scenario 1You act as an executor for an estate and have recently moved the office you work in. You need to ensure that any IRS communications concerning the estate reach you promptly and are not misdirected. Scenario 2Your business has expanded, and operations moved to a new location. To prevent any interference in your tax matters related to the business, you might want to inform IRS about the relocation with the IRS 8822 change of address form. Scenario 3You've recently married and changed your last name. Although it’s primarily used to report changes in address, Form 8822 can also be utilized to update your name change with the IRS. In all these instances, IRS Form 8822 will serve to communicate the vital details effectively with the IRS. The process isn’t cumbersome, and the form itself can be downloaded online, which we'll discuss momentarily. What to do if a Mistake Occurs? Human errors can transpire while filling out forms and IRS Form 8822 is no exception. It's indispensable to double-check all the information enlisted on the form before submission. However, if an error is identified post-submission, don't fret. The IRS will return to you a printable IRS Form 8822: Change of Address that needs to be correctly filled out and sent back to them. Popular Questions about Form 8822 Below are answers to some common queries about this form: Can I submit IRS Form 8822, Change of Address, online?According to the current instructions, you cannot e-file it. You have to fill out this form on paper and send it to the IRS. The address to which you have to send this form depends on your state or location. How often can I update my address?Theoretically, you can update your address as many times as you'd like. Practicality, however, dictates you only do so whenever an actual change occurs. Where can I find the form?You can print IRS Form 8822 (Change of Address) directly from our website, prepare the requisite information, and mail it to the IRS. Staying on top of changes and maintaining clear communication with the IRS can lead to smoother tax seasons. By understanding the purposes of IRS Form 8822 and how it works, you'd be doing precisely that! Fill Now -

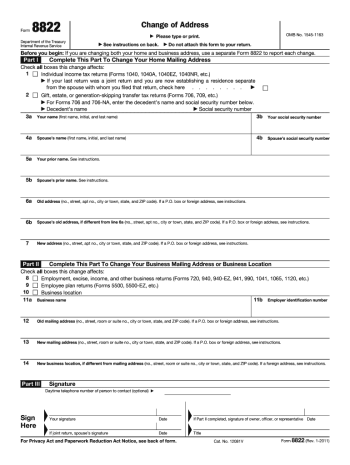

![image]() Form 8822 Online Relocation and shifting your commercial offices can be a stressful experience. Out of the many things to bear in mind at this time, one crucial aspect many individuals and organizations often forget is to update the IRS with their new address. This is where IRS Form 8822 – an essential tool for indicating a change of address – comes into play. The importance of appropriately informing the IRS of your relocation cannot be overemphasized. Whether you handle business accounts or are an individual taxpayer, the IRS must always have your most current address on record. Doing so with the IRS 8822 form online is a significant convenience in the digital era. Variations of IRS Form 8822 While the IRS provides a traditional, paper-based way of sharing your address change, the chance to fill out your 8822 form online is a key feature of the modifiable version. Not only is this paperless option quick and efficient, but it also ensures your form reaches the IRS promptly. This form accounts for personal, business, or estate-related address changes and even helps corporations inform the IRS about a changing location of their tax records. Besides, to help taxpayers who concurrently manage various tax categories, now, you get an online service to file IRS Form 8822 digitally. IRS Form 8822: Online Submission & Challenges While filing your bottom line on the online form for updating your address may seem like a swift process, wholly benefiting from Form 8822 for change of address online brings its obstacles. One such concern is achieving a successful submission without error. You may find navigating the website complex and following the correct sequence of filling the form digitally. Acquainting yourself thoroughly before undertaking this task is, therefore, essential. While these forms are not typically as complex as other IRS paperwork, understanding them is a crucial first step to successful completion. Tips for Effective Form 8822 Online Completion Firstly, ensure your web browser and the version of Adobe Reader on your device are up-to-date. This will enable you to update, save and file IRS Form 8822 online without unexpected crashes or data loss. Sometimes, you may face a slow server response, unscheduled maintenance periods, or common technical glitches. Always have patience and try submitting the form during off-peak hours to ensure a smoother process. If you encounter an error, do not hesitate to contact the helpline. After all, the most important thing is to ensure your form sees successful submission. While IRS Form 8822 online provides an expedited platform for updating your address, remember these important tips to ensure a smooth transaction. Adept preparation and a little patience are your dearest companions during this process. Fill Now

Form 8822 Online Relocation and shifting your commercial offices can be a stressful experience. Out of the many things to bear in mind at this time, one crucial aspect many individuals and organizations often forget is to update the IRS with their new address. This is where IRS Form 8822 – an essential tool for indicating a change of address – comes into play. The importance of appropriately informing the IRS of your relocation cannot be overemphasized. Whether you handle business accounts or are an individual taxpayer, the IRS must always have your most current address on record. Doing so with the IRS 8822 form online is a significant convenience in the digital era. Variations of IRS Form 8822 While the IRS provides a traditional, paper-based way of sharing your address change, the chance to fill out your 8822 form online is a key feature of the modifiable version. Not only is this paperless option quick and efficient, but it also ensures your form reaches the IRS promptly. This form accounts for personal, business, or estate-related address changes and even helps corporations inform the IRS about a changing location of their tax records. Besides, to help taxpayers who concurrently manage various tax categories, now, you get an online service to file IRS Form 8822 digitally. IRS Form 8822: Online Submission & Challenges While filing your bottom line on the online form for updating your address may seem like a swift process, wholly benefiting from Form 8822 for change of address online brings its obstacles. One such concern is achieving a successful submission without error. You may find navigating the website complex and following the correct sequence of filling the form digitally. Acquainting yourself thoroughly before undertaking this task is, therefore, essential. While these forms are not typically as complex as other IRS paperwork, understanding them is a crucial first step to successful completion. Tips for Effective Form 8822 Online Completion Firstly, ensure your web browser and the version of Adobe Reader on your device are up-to-date. This will enable you to update, save and file IRS Form 8822 online without unexpected crashes or data loss. Sometimes, you may face a slow server response, unscheduled maintenance periods, or common technical glitches. Always have patience and try submitting the form during off-peak hours to ensure a smoother process. If you encounter an error, do not hesitate to contact the helpline. After all, the most important thing is to ensure your form sees successful submission. While IRS Form 8822 online provides an expedited platform for updating your address, remember these important tips to ensure a smooth transaction. Adept preparation and a little patience are your dearest companions during this process. Fill Now -

![image]() IRS Form 8822 PDF The Internal Revenue Service handles a substantial amount of paperwork, with numerous forms available to fill out, depending on individual circumstances. One such document integral to the IRS's functioning is the IRS Form 8822 PDF. But before proceeding into nitty-gritty details, let's first understand the form and its application. What's the Purpose of IRS Form 8822? Here is a form, formally titled as Form 8822 (Change of Address) PDF, which plays a crucial role in smooth communication between taxpayers and the IRS. It's primarily used to report changes in your personal or business address. Consistent within all states, it ensures the IRS is able to send out critical notifications about your tax filings effectively. It can be filed voluntarily or becomes essential in the aftermath of a significant life event such as relocation, a name change after marriage or divorce, or a change in the responsible party for a business. Key Elements to Consider If you are submitting IRS 8822 form as PDF, ensure giving the correct and most recent address. Inconsistencies between the IRS record and your given address might lead to a communication failure. A distinct form exists for reporting business changes (Form 8822-B). After filling out the PDF version of Form 8822, mail it to the specified IRS address mentioned in the form's instructions. It is not available for online submission. Avoidable Errors on Form 8822 Even straightforward forms can prove challenging to inexperienced taxpayers. Below are some prevalent errors seen in the completed Form 8822 for 2023 in PDF: Inconsistency in old and new addresses because of misspelled location names or numbers. Different forms are used instead of Form 8822 for informing about business changes. All boxes aren't filled without ambiguity or reserve. To avoid this, ensure you read each section precisely, fill in accurate information, opt for the correct form, and follow up. Also, keep a copy of the sent form for your records. Concluding Remarks Comprehending Form IRS 8822 in PDF is quite straightforward. However, it holds considerable significance as it helps maintain an open line of communication with the IRS. By ensuring accurate completion and timely submission of this form, taxpayers can avoid undue stress associated with lost mail or unnecessary penalizations. From this guide, you should understand how complex tax forms can be and how to approach them systematically. Fill Now

IRS Form 8822 PDF The Internal Revenue Service handles a substantial amount of paperwork, with numerous forms available to fill out, depending on individual circumstances. One such document integral to the IRS's functioning is the IRS Form 8822 PDF. But before proceeding into nitty-gritty details, let's first understand the form and its application. What's the Purpose of IRS Form 8822? Here is a form, formally titled as Form 8822 (Change of Address) PDF, which plays a crucial role in smooth communication between taxpayers and the IRS. It's primarily used to report changes in your personal or business address. Consistent within all states, it ensures the IRS is able to send out critical notifications about your tax filings effectively. It can be filed voluntarily or becomes essential in the aftermath of a significant life event such as relocation, a name change after marriage or divorce, or a change in the responsible party for a business. Key Elements to Consider If you are submitting IRS 8822 form as PDF, ensure giving the correct and most recent address. Inconsistencies between the IRS record and your given address might lead to a communication failure. A distinct form exists for reporting business changes (Form 8822-B). After filling out the PDF version of Form 8822, mail it to the specified IRS address mentioned in the form's instructions. It is not available for online submission. Avoidable Errors on Form 8822 Even straightforward forms can prove challenging to inexperienced taxpayers. Below are some prevalent errors seen in the completed Form 8822 for 2023 in PDF: Inconsistency in old and new addresses because of misspelled location names or numbers. Different forms are used instead of Form 8822 for informing about business changes. All boxes aren't filled without ambiguity or reserve. To avoid this, ensure you read each section precisely, fill in accurate information, opt for the correct form, and follow up. Also, keep a copy of the sent form for your records. Concluding Remarks Comprehending Form IRS 8822 in PDF is quite straightforward. However, it holds considerable significance as it helps maintain an open line of communication with the IRS. By ensuring accurate completion and timely submission of this form, taxpayers can avoid undue stress associated with lost mail or unnecessary penalizations. From this guide, you should understand how complex tax forms can be and how to approach them systematically. Fill Now