Form 8822 Guide & How to Report the Change of Address to the IRS

For a business owner or individual who has recently relocated or switched mailing addresses, it is crucial to maintain seamless communication with tax agencies. This is where federal form 8822 comes into play. It is specifically designed by the Internal Revenue Service to report any changes in a taxpayer's business or home location. Submitting this form ensures important taxation mail such as refunds, amendment notifications, or requirements for additional information will not be misdirected, thus facilitating a smooth tax filing process.

One valuable resource for understanding and navigating these changes is our website, 8822-form.com. Here, you can find an IRS 8822 form to download, free of charge, eliminating the need for physical visits to an Internal Revenue Service office. Dedication to guiding everyone from first-time filers to seasoned taxpayers, this digital platform also provides detailed IRS Form 8822 instructions that can significantly simplify the filling process.

IRS 8822 Tax Form: Example of Use

Under the U.S. tax system, the IRS Form 8822 is an essential document many must engage with. This includes any individual, business, or organization experiencing an address or responsible party change. Understanding this may raise the question, where could one access a printable 8822 form?

Meet Jane. Jane is a small business owner who recently relocated her bakery to a bustling part of town. As her business address has changed, Jane must now face the task of notifying the IRS. Jane’s bookkeeper suggests downloading a printable 8822 form. But the challenge doesn't end there. It is equally as essential to comprehend the 8822 form instructions. Thus, Jane decides to delve in. Learning these guidelines will ensure that she accurately completes and submits her copy, preventing any miscommunication with the IRS.

File Form 8822 Online

Now, you might be thinking, "Can I e-file this document?". Yes, indeed, you can file IRS Form 8822 online, making this process even more streamlined for people like Jane. This feature saves valuable time she can now spend focusing on her flourishing business.

Instructions to Fill Out Form 8822

- The first thing you will be expected to do is obtain IRS Form 8822 for download. Scroll to the top of the homepage and click the "Get Form" button. In the new window, you need to find the arrow button and save the file to your device.

- Preparing to file your taxes can be a daunting task, but a necessary one. Once you have the IRS 8822 form PDF, prepare the requested information to fill in the template, including your new mailing address and your Social Security Number. This information is essential to ensure accuracy and compliance with IRS regulations.

- Fill all the details in the specified fields as clearly as possible to avoid any confusion, which may result in delays.

- Once you're finished with the document, remember to double-check if you've filled all fields correctly to void potential errors.

- After the verification, save your filled-out copy and make a print, if necessary, for your records.

- Finally, send the completed Form 8822 to the IRS in the required method and be on the lookout for any communication from their end. Remember to handle all your tax affairs promptly and as required by law. As Benjamin Franklin aptly says, "In this world, nothing can be said to be certain except death and taxes."

Proper Time to File the 8822 Form

The 8822 tax form can be filed without the stress of a firm deadline. Yes, you read that right. The Internal Revenue Service does not specify a due date for this form. Instead, you should file the 8822 form promptly after any change in your address to ensure that you receive all tax-related correspondence without delay. The IRS wants to be kept informed, aiming to maintain efficient communication with taxpayers.

The 8822 tax form can be filed without the stress of a firm deadline. Yes, you read that right. The Internal Revenue Service does not specify a due date for this form. Instead, you should file the 8822 form promptly after any change in your address to ensure that you receive all tax-related correspondence without delay. The IRS wants to be kept informed, aiming to maintain efficient communication with taxpayers.

As there's no concrete timetable, the question of applying for an extension does not actually arise. Nevertheless, it's certainly recommendable that you fill out the 8822 form as soon as you can to keep all tax affairs in tip-top shape. An accurate mailing address will contribute to smoother, swifter tax assessments and responses from the IRS. So, stay ahead of the curve, understand your obligations, and keep that communication bridge with the IRS clear and consistent.

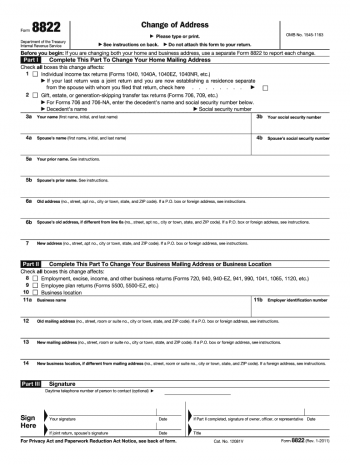

Blank Form 8822: Essential Boxes to Consider

- The P.O. Box and 'In Care of' address sections of the 8822 tax form are essential features to grasp. Critical to note that the IRS utilizes these fields for the sole purpose of correspondence. If you have a physical address, you don't need to provide a P.O. Box unless you're relying on it for your mail.

- Completing the 'In Care of' section of the form merely means that your mail would be addressed to an individual or organization at the location specified. This is typically used if you're residing overseas or have employed a tax service to help handle your accounts.

Before grabbing your IRS 8822 form printable, you need to distinguish between this application and 8822-B. The former is for changes of address, whereas the latter is for changes of identity or authority within a business.

Q&A: Federal Tax Form 8822

- What is the specification of the IRS 8822 form online version?The IRS 8822 form online version is a legal document used to report a change in address for business and personal taxpayers. Taxpayers must fill it out and submit it after moving to a new place to ensure the IRS has their correct contact information. It contains fields for personal information, old and new addresses, signatures, and dates.

- How can I obtain the free 8822 form?Users can obtain a free copy by following the link on our website. You can download the file, fill in the necessary information, and submit it to the IRS without incurring any charges. Notably, it provides a cost-effective solution for individuals and businesses to update their addresses.

- What are the main rules to correctly fill in printable IRS Form 8822: Change of Address?It is important to provide accurate and up-to-date information to fill the document correctly. You must include basic personal information and your old and new full addresses. The copy should be signed, dated, and mailed to the IRS at the designated office.

- Where can I find IRS Form 8822 printable version?The printable version of IRS Form 8822 can be found on the IRS website. After downloading the document, it can be printed and filled out manually. This option provides the flexibility of using pen and paper, which some taxpayers prefer.

- Can I download the IRS Form 8822 in PDF?Yes, the IRS Form 8822 in PDF format can be downloaded directly from our website. After downloading, you can fill it out using any PDF editing software and save your changes before submitting it. This makes the task easier and allows the users to keep a digital copy for their records.

- Can I use tax form 8822 (Change of Address) in 2023?Absolutely, you must do that if you recently have changed the address. Irrespective of the year, this document should always be used to update the address information with the IRS. This long-standing sample is part of the IRS forms portfolio and will still effectively provide taxpayers with address updates.

More About Form 8822 & Change of Address

-

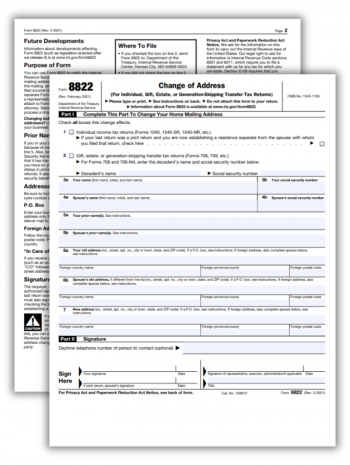

![image]() Printable IRS Form 8822 Understanding and completing the IRS tax form 8822 printable can be complex for many individuals. Form 8822, often called the Change of Address form, is designed for taxpayers who need to notify the Internal Revenue Service (IRS) about a change in their personal or business mailing address. The prim... Fill Now

Printable IRS Form 8822 Understanding and completing the IRS tax form 8822 printable can be complex for many individuals. Form 8822, often called the Change of Address form, is designed for taxpayers who need to notify the Internal Revenue Service (IRS) about a change in their personal or business mailing address. The prim... Fill Now -

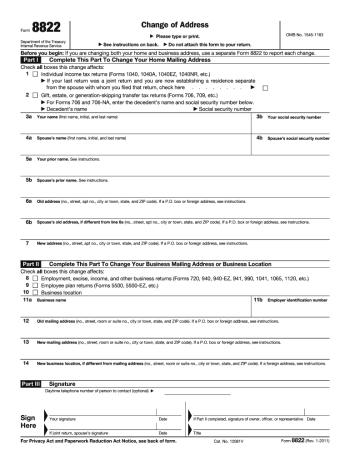

![image]() IRS Tax Form 8822 The IRS tax form 8822 frequently comes up once you move, as it is the official document the Internal Revenue Service uses to update your physical or mail address. It's crucial to update your contact information with the IRS to ensure any necessary correspondence reaches you. Being kept informed of y... Fill Now

IRS Tax Form 8822 The IRS tax form 8822 frequently comes up once you move, as it is the official document the Internal Revenue Service uses to update your physical or mail address. It's crucial to update your contact information with the IRS to ensure any necessary correspondence reaches you. Being kept informed of y... Fill Now -

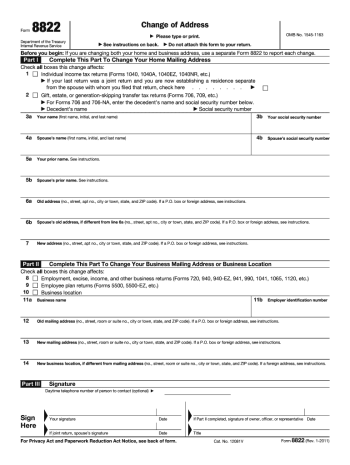

![image]() Form 8822 (Change of Address) When you alter your physical address, ensuring that the Internal Revenue Service (IRS) is notified should be one of the top priorities on your checklist. Keeping IRS apprised of your current whereabouts prevents potential delays or miscommunication concerning your tax matters. This is where IRS Form... Fill Now

Form 8822 (Change of Address) When you alter your physical address, ensuring that the Internal Revenue Service (IRS) is notified should be one of the top priorities on your checklist. Keeping IRS apprised of your current whereabouts prevents potential delays or miscommunication concerning your tax matters. This is where IRS Form... Fill Now -

![image]() Form 8822 Online Relocation and shifting your commercial offices can be a stressful experience. Out of the many things to bear in mind at this time, one crucial aspect many individuals and organizations often forget is to update the IRS with their new address. This is where IRS Form 8822 – an essential tool fo... Fill Now

Form 8822 Online Relocation and shifting your commercial offices can be a stressful experience. Out of the many things to bear in mind at this time, one crucial aspect many individuals and organizations often forget is to update the IRS with their new address. This is where IRS Form 8822 – an essential tool fo... Fill Now